MileBug (LITE) - Mileage Log app for iPhone and iPad

Developer: Izatt International

First release : 21 Oct 2008

App size: 41.6 Mb

Track your trips, increase your 2018 deduction!

MileBug is the reliable GPS mile tracker that makes it easy to track your trips and related expenses so you get the tax deduction you deserve.

• Full Version Hit #1 in Finance (U.S. - January 2017)

• “5 Apps Your Accountant is Begging You to Have in 2015″ - Smart Hustle Magazine

• Businessweek lists MileBug as 1 of 4 Tax Record Services (April 2013)

• "Milebug saves you time and money; and is a MUST have for any business owner." -- iReviewiPhoneApps

LITE has GPS tracking "as the crow flies" and a limit of 10 trips at a time.

FULL has GPS full path tracking with MAP DISPLAY! No limit on number of trips. Plus also runs on iPad as a Universal App.

RELIABILITY

• Easily export drive reports to excel or spreadsheets using CSV forms

• Easily email your drive reports

• NEW MileBug Cloud using Google Firebase ($1.99 IAP)

• iTunes File Sharing - Save a drive data file to your computer. You can restore it to the same or new device even if your phone is lost or damaged.

SAVINGS

• Get $5.45 in deductions for every 10 business miles tracked in 2018

• Save on battery life over other mile trackers that are constantly running

• No expensive monthly tracking fee

• Track trip related expenses for even more tax savings

TRACKING:

• Full GPS path tracking (w/MAP DISPLAY)

• This GPS mile tracker drops a pin on the map view every 1/10 mile (approx). Edit the trip by dragging pins.

• Create custom categories for drive purposes

DEMO TRAINING VIDEO

• http://bit.ly/MileBugVideo15

FULL FEATURE LIST:

• Track miles/km for MULTIPLE businesses

• Track miles/km for MULTIPLE charities

• Track miles/km for "Medical" or even "Other"

• Create your own expense categories

• Tracks your trips using GPS (full path on map)

• Data backup via MileBug Cloud ($1.99 IAP)

• Data backup via iTunes File Sharing

• INTERNATIONAL SUPPORT: km/miles, custom rates, etc.

• Use Frequent Trips to save time

• Setup multiple vehicles...and name them!

• Custom Field per Trip, sortable in reports (e.g. client, project, etc)

• Odometer screen updates when changing vehicles

• Automatically opens to Edit for incomplete trip

• Designed to be IRS compliant

• Setup frequent destinations and purposes for easy use later

• Easily edit/delete/reorder Presets (see blog for more info: milebug.com)

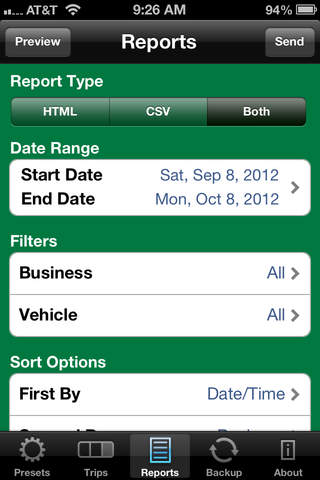

• Email HTML and Excel-friendly (CSV) reports

• Define date range of each report

• See report totals by business and vehicle

• Presets allow for trip recording with simple finger taps

• Clear Trips List when you want a fresh start

• See the deduction amount for each trip

• Incomplete trip badge on home screen icon

• Intuitive native iPhone/iPad interface

• Choose start screen in Settings

• How few miles will it take you to pay for MileBug?

SEE OUR BLOG: www.milebug.com (leave comments!)

"MileBug is a mileage tracker for your iPhone or iPod Touch that makes it super easy to. . .track your mileage. This is great if you need to report your mileage to your boss. . .the [IRS]. . .or for any personal reasons." -- App Store Apps

"Milebug saves you time and money; and is a MUST have for any business owner." -- iReviewiPhoneApps

IRS tax deduction rates are 54.5 cents/mile for 2018! Take advantage of these rates by keeping track of the miles you drive for your businesses, for charities, or for personal medical reasons. With MileBug, it’s never been easier to make a trip log!

Continued use of GPS running in the background can dramatically decrease battery life

Cellular data plan or WiFi required for proper use of GPS